Global Sisters is here to make business possible for all women.

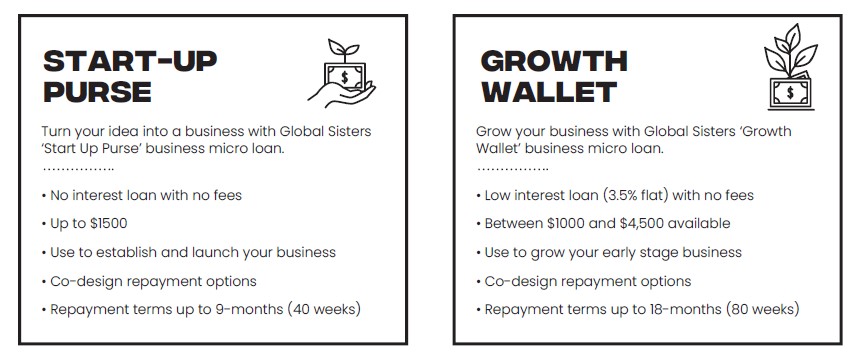

Starting and scaling a business takes time and money, and we know how much of a barrier that can be for our Sisters. As a result, we have created the Micro Loan program.

A Global Sisters Micro Loan offers two options: one for starting your business and one for scaling your business.

Three reasons we’re proud of our loans.

- They are PRODUCTIVE – these loans are used to move your business forward.

- They are REGENERATIVE – when one loan is paid off, we have the funds available to help another Sister.

- They are VALIDATING – if you receive a loan, that is proof that we believe in you and your business.

This loan is only available to our Sisters. If you are participating in Sister School, our Solo Mums programs or Financial Pathways, we’d love for you to apply.

We recommend you watch our Micro Loan Information session prior to applying for a Micro Loan.

The not-so-small print?

- The loans are for business purposes only. You must have an ABN to be eligible

- You must have a separate bank account, accessible only by you, for us to disburse your funds into

- You must be over 18

- You must be an Australian Resident

- You must be an Active Sister (active participant in Global Sister’s Sister School, Solo Mums Program or Financial Pathways programs)

- Applying for the micro loan does not affect your credit score

- The business must be operated in Australia

- The loan is not to be used to service debt.

What we need:

- 100 points of ID (passport, drivers licence, Medicare card)

- Business Model Canvas (Start Up Purse) or Business Plan (Growth Wallet)

- A demonstrated ability to repay the loan (family budget or credit rating)

- A list of current debts: loans, credit cards, family and friend loans, BNPL

- An itemised list of what you intend to use the loan for

- A financial model * showing your expected Cash Flow Budget and Profit and Loss for 6 – 12 months (depending on the loan type). This will also be used to show the impact the loan will have on your business.

* NB the thought of submitting a financial model put you off? We are here to support you! We run Money Meetups where I will go through the model in a group setting. You can ask questions or just watch, learn and work as we go.

The Micro Loan Process:

The Finance Specialist will review applications as they come in. She may email you to seek further information regarding your application.

Once the application process is closed, the Loan Committee will meet to discuss all applications and determine who has been successful. The process can take up to 4 weeks.

If you are unsuccessful this round, we will provide feedback and support. And do not worry – you are always welcome to reapply in the future.

You might also like...

This page is to apply for Global Sisters Business Micro Loan program.

Global Sisters is in the process of developing a suite of Financial Pathways supports. In the meantime, we recommend checking out part of our Sister School program that focuses on business finances.

Money Matters – Part 5 of Sister School

For basic business finance support, we recommend Part 5 of Sister School focused on getting to know your business foundations.

Got questions? If you have any questions, email us at microloanprogram@globalsisters.org

About Instructor